Should you send written thank-you’s to donors? Again?

Only if you want them to give again!

242 Cards for Groundhog Day

My wife, Rona Fischman, sends handwritten cards to every one of her past real estate clients for Groundhog Day.

Why Groundhog Day? Nothing to do with Bill Murray! It’s just that the December holidays are an emotional minefield, with some people firmly attached to Christmas, Chanukah, Yule, or Kwanzaa, and some who don’t want to identify with any of them.

Sending cards on Groundhog Day offends no one, and it tickles the Wiccans. It puts good wishes in the mailbox when everyone else isn’t flooding the recipients with mail. It also puts former clients in mind of 4 Buyers Real Estate just as the spring season is about to begin and they–or someone they know–is starting to think of buying a house (and needs a good agent).

The more important question is, why hand-written cards? That, too, makes Rona and her company stand out. It is on brand for them to show they care about each client individually, and remember their needs.

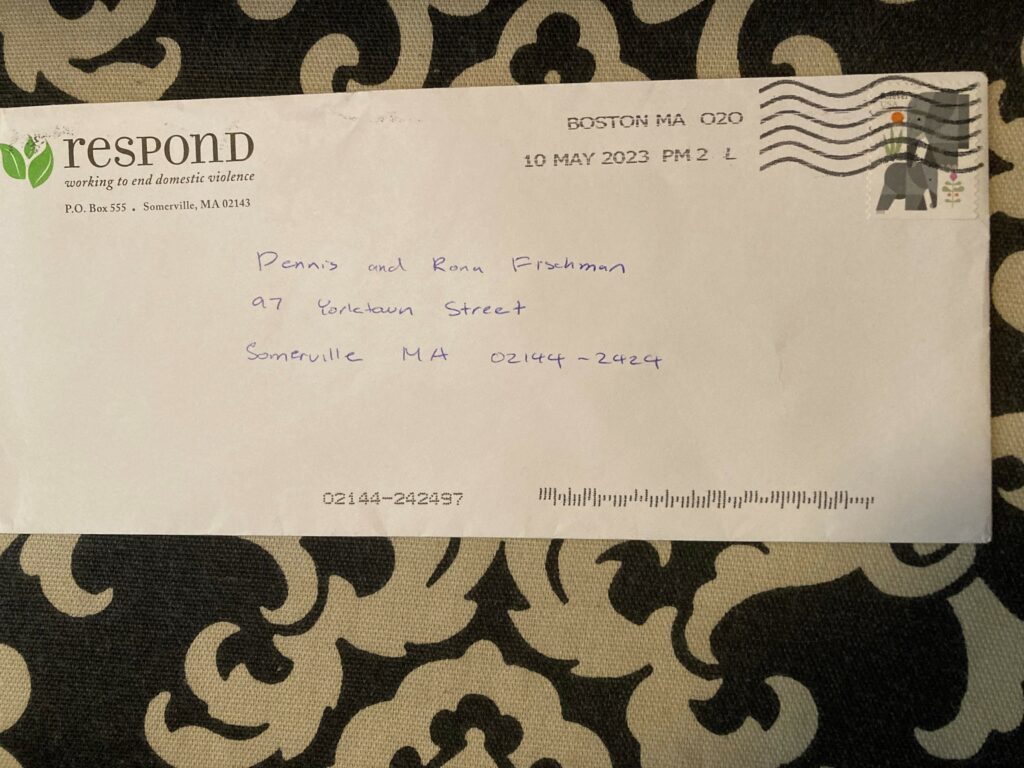

Do your nonprofit's donors know that you remember and care about them? A hand-written thank-you in the mail makes sure that they do. Share on XWhy It’s Worth Your Time to Send TY’s in the Mail

You may be saying to yourself, “We automatically email donors as soon as their check or credit card number hits our system. Why do we need to send mail, too? And is it really worth the time to personalize them?”

It’s only worth it if you want to hear from them again!

Nonprofits are having a hard time getting that second gift, according to the Association of Fundraising Professionals, “with recaptured donor retention falling almost 20% [in 2023] from an already low level.” You may be seeing that in your own database. You spend so much time and care crafting the fundraising appeal, and you get a donation from a person or household for the first time–and then, they ghost you. Why?

Okay, sometimes it has nothing to do with you. The donor lost their job and they have no money available for philanthropy. Most of the time, however, it’s because they didn’t feel their first gift was seen, or valued, or appreciated. You made your organization the hero of the story and left them out.

Here’s what you can do instead:

- Write the ideal thank-you letter.

- Put it in the mail using the name they want to be called by, with a live stamp.

- Tell a story to show impact.

- Have the letter signed in ink, by an important person at your organization: the Executive Director, a Board member, or a person the donor actually knows.

- Make it personal, not just personalized.

Will all that take time? Yes! Rona watched several episodes of her favorite police procedural while she was writing her cards. You can do something similar, if you like. Listen to music, or a podcast, if you don’t want to keep glancing up at the screen.

Will it be worth it? Yes! When you see the first-time giver become a loyal donor, with a lifetime value far higher than any one-time gift, you will be saying thank you to yourself that you took the time to thank them.